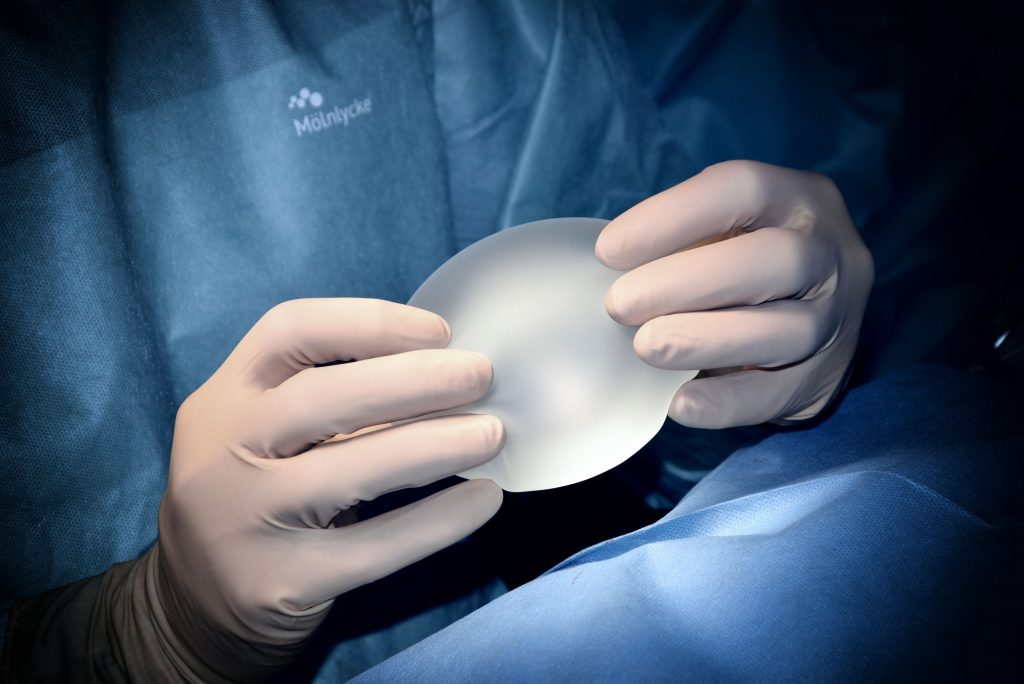

The Ultimate Guide to Financing Breast Augmentation with Confidence

Breast augmentation is a popular cosmetic procedure that can enhance your confidence and self-image. However, the cost of breast augmentation can be a significant factor that may deter some individuals from pursuing their desired aesthetic goals. Fortunately, there are financing options available that can make breast augmentation more accessible. In this comprehensive guide, we will explore how to finance breast augmentation with confidence, empowering you to make informed decisions about your financing options and embark on your transformational journey. Understanding Breast Augmentation Financing Breast augmentation financing refers to the financial assistance provided by reputable lenders or specialized medical financing companies to cover the cost of the procedure. By spreading the cost over a set repayment period, financing options enable individuals to undergo breast augmentation without having to pay the entire amount upfront. Benefits of Financing Breast Augmentation Achieve your desired results sooner: Financing breast augmentation allows you to proceed with the procedure when you’re ready, rather than waiting until you have saved enough money. This way, you can attain your desired results and enjoy the benefits of an enhanced silhouette sooner. Customized repayment plans: Financing options offer flexible repayment plans tailored to your financial situation. You can choose a repayment period that aligns with your budget and comfortably manage your monthly payments. Maintain financial stability: Financing allows you to preserve your financial stability rather than depleting your savings or disrupting your regular budget. You can retain your savings for unexpected expenses or future investments while pursuing your desired breast augmentation procedure. Access to reputable providers: Financing options often work in collaboration with reputable cosmetic surgeons and clinics, ensuring that you have access to experienced professionals who prioritize your safety and satisfaction. Steps to Finance Breast Augmentation with Confidence Research reputable lenders: Start by researching and identifying reputable lenders or medical financing companies that specialize in cosmetic surgery procedures. Look for companies with a track record of providing transparent terms, competitive interest rates, and excellent customer service. Evaluate your financial situation: Assess your financial circumstances, including your income, expenses, and credit score. Understanding your financial position will help you determine the loan amount you can comfortably manage and qualify for. Consult with a board-certified plastic surgeon: Schedule consultations with board-certified plastic surgeons experienced in breast augmentation. Discuss your goals, expectations, and any concerns you may have. They can provide you with a detailed treatment plan and cost estimate, which will guide your financing decisions. Compare financing options: Obtain quotes from different lenders or financing companies and compare their interest rates, repayment terms, and fees. Look for options that align with your budget and offer the most favorable terms. Understand the terms and conditions: Before finalizing any financing agreement, carefully review the terms and conditions provided by the lender. Pay attention to the interest rate, repayment schedule, any associated fees, and penalties for late payments or early repayment. Apply for financing: Once you have selected a financing option, complete the application process. Be prepared to provide the necessary documentation, which may include proof of income, identification, and details about the planned breast augmentation procedure. Plan your budget: Once you receive approval for financing, develop a comprehensive budget that includes the loan payments along with other associated costs, such as pre-operative tests, surgical fees, post-operative care, and potential follow-up visits. Maintain a realistic outlook: While financing allows you to achieve your desired breast augmentation, it’s important to maintain realistic expectations. Communicate openly with your plastic surgeon about the outcomes you desire, ensuring that you have a clear understanding of what can be achieved through the procedure. Schedule your procedure: With the financing in place and a well-planned budget, schedule your breast augmentation procedure with your chosen plastic surgeon. Follow all pre operative instructions provided by your surgeon to ensure a smooth and successful procedure. Manage your loan payments responsibly: Once your breast augmentation is complete, it’s crucial to manage your loan payments responsibly. Make timely monthly payments to the lender, prioritizing your financial obligations to maintain a positive credit history. This will help build your creditworthiness and potentially open doors to future financing opportunities. Conclusion Financing breast augmentation can provide a practical solution for individuals seeking to enhance their self-confidence and achieve their aesthetic goals. By understanding the available financing options, evaluating your financial situation, and working with reputable lenders and experienced plastic surgeons, you can embark on your breast augmentation journey with confidence. Remember to research and compare financing terms, create a realistic budget, and maintain responsible financial management throughout the repayment period. With the right financing strategy, you can access the transformative benefits of breast augmentation and embark on a journey to a more confident and empowered you. Follow us on social: Linkedin-in Facebook-f Instagram Twitter

Affordable Enhancements: Financing Non-Surgical Cosmetic Procedures

In the realm of cosmetic enhancements, non-surgical procedures offer individuals the opportunity to enhance their appearance without undergoing invasive surgery. From wrinkle reduction to non-surgical body contouring, these procedures have gained popularity due to their minimal downtime and impressive results. However, the cost can be a concern for many individuals considering such treatments. Luckily, there are financing options available that make non-surgical cosmetic procedures more accessible and affordable. In this blog post, we will explore the benefits of financing and provide guidance on how to finance non-surgical cosmetic procedures, allowing you to achieve your aesthetic goals without straining your budget. Understanding Non-Surgical Cosmetic Procedures Non-surgical cosmetic procedures encompass a wide range of treatments that help improve various aspects of one’s appearance. These treatments typically involve the use of injectables, lasers, or other non-invasive techniques. Some popular non-surgical procedures include Botox injections, dermal fillers, laser hair removal, non-surgical body sculpting, and skin rejuvenation treatments. The Benefits of Non-Surgical Cosmetic Procedures Non-surgical cosmetic procedures offer several advantages over traditional surgical options. These include: Minimal downtime: Unlike surgical procedures that often require significant recovery time, non-surgical treatments usually involve minimal to no downtime. This means you can resume your daily activities almost immediately. Non-invasive: Non-surgical procedures are performed without the need for incisions, reducing the risk of complications and scarring. Targeted results: Non-surgical treatments can address specific concerns, such as fine lines, wrinkles, volume loss, excess fat, or skin texture, providing targeted and customizable results. Cost-effective: Non-surgical procedures are generally more affordable than surgical alternatives, making them accessible to a wider range of individuals seeking cosmetic enhancements. Financing Options for Non-Surgical Cosmetic Procedures Financing can be a viable solution if you are interested in non-surgical cosmetic procedures but are concerned about the upfront cost. Here are some financing options to consider: Medical credit cards: Many healthcare providers accept medical credit cards that are specifically designed to cover medical expenses. These cards often offer promotional financing plans with low or no interest rates for a certain period. Personal loans: Personal loans can be obtained from banks, credit unions, or online lenders. They provide a lump sum amount that can be used to cover the cost of non-surgical cosmetic procedures. Compare interest rates and repayment terms to find the most suitable loan for your needs. Financing plans offered by providers: Some cosmetic clinics or medical practices offer in-house financing plans. These plans allow you to make monthly payments over a specific period, often with low or no interest rates. Be sure to understand the terms and conditions before committing to such a plan. Credit cards: Using a credit card for financing is another option. Some credit cards offer promotional 0% APR periods for new cardholders, allowing you to pay off the balance interest-free within a specific timeframe. However, be mindful of high-interest rates that may apply once the promotional period ends. Tips for Financing Non-Surgical Cosmetic Procedures Now that you’re aware of the financing options available, here are some tips to help you navigate the process: Research and compare: Take the time to research different financing options, and compare interest rates, repayment terms, and fees. Consider factors such as the total cost, monthly payments, and any penalties for early repayment. Budget wisely: Before committing to financing, assess your financial situation and create a budget. Determine how much you can comfortably allocate toward monthly payments without straining your finances. Consult with multiple providers: Schedule consultations with different cosmetic clinics or medical professionals offering the non-surgical procedure you are interested in. During these consultations, inquire about their financing options and ask for a breakdown of the costs involved. This will help you make an informed decision and choose the provider that best suits your needs and budget. Read the fine print: Before signing any financing agreement or contract, carefully read and understand the terms and conditions. Pay attention to interest rates, repayment schedules, any additional fees or penalties, and cancellation policies. If you have any doubts or questions, seek clarification from the provider. Consider long-term financial impact: While financing can make non-surgical cosmetic procedures more accessible, it’s essential to consider the long-term financial impact. Assess how the monthly payments will fit into your overall budget and whether you can comfortably afford them in the coming months or years. Explore alternative options: If the cost of financing the entire procedure seems daunting, consider partial financing or explore alternative treatments that may be more budget-friendly. Your healthcare provider can guide you in finding alternative treatments or creating a phased approach to achieve your aesthetic goals. Maintain realistic expectations: Financing non-surgical cosmetic procedures can open doors to enhancing your appearance, but it’s important to maintain realistic expectations. Understand the limitations and potential outcomes of the procedure you are considering. Focus on achieving a natural, balanced look that enhances your features rather than striving for perfection. Conclusion Financing non-surgical cosmetic procedures can provide a pathway to achieving your desired aesthetic goals without a significant financial burden. You can make informed decisions that align with your financial capabilities by exploring various financing options, conducting thorough research, and creating a well-thought-out budget. Remember to consult with reputable providers, read the terms and conditions carefully, and prioritize your long-term financial well-being. With the right financing strategy in place, you can embark on your journey toward affordable enhancements and boost your confidence through non-surgical cosmetic procedures. Get Help from United Credit Undergoing treatment for non-surgical cosmetic procedures can be expensive. Fortunately, United Credit can help you find solutions for financing cosmetic work. We work with multiple lending partners to help you secure the loan you need for funding treatment services. Apply for a consumer loan today to explore your options. United Credit strives to keep the content shared on this blog accurate and up to date. You are urged to consult with business, financial, legal, tax and/or other advisors and/or medical providers with respect to any information presented. Opinions expressed here are the author’s alone and have not been approved or otherwise endorsed by

How Much Does a BBL Cost? Everything You Need to Know

If you’ve been contemplating the idea of enhancing your body’s natural curves and overall appearance, you’ve probably come across the term “Brazilian Butt Lift” or “BBL” in your research. This popular cosmetic procedure is garnering attention worldwide, but how much does a BBL cost? And is it worth the investment? In this blog post, we will dive into the world of Brazilian Butt Lifts, discussing what the procedure entails, how much it costs, financing options, and whether or not it is covered by insurance. By the end, you’ll be well-equipped with the knowledge you need to make an informed decision about this transformative cosmetic surgery. What is a Brazilian Butt Lift (BBL)? A Brazilian Butt Lift (BBL) is a cosmetic surgery procedure that involves the transfer of fat from one area of the body to the buttocks to enhance its shape, volume, and overall appearance. This is achieved through a process called fat grafting or liposuction, followed by fat transfer. It is a popular choice for those looking to achieve a more curvaceous and aesthetically pleasing silhouette. The BBL Procedure The Brazilian Butt Lift is typically performed under general anesthesia, although local anesthesia with sedation may be used in some cases. The surgery usually lasts between two to four hours, depending on the patient’s specific needs. Liposuction: The first step in the BBL procedure is the removal of fat from the donor areas, which can include the abdomen, flanks, lower back, and thighs. Your surgeon will make small incisions in the targeted areas and insert a thin tube called a cannula. They will then use the cannula to loosen and remove the excess fat from the body. Fat Processing: After the fat has been harvested, it is purified and processed to separate the healthy fat cells from any impurities. This process ensures that only the best-quality fat is used for the transfer to the buttocks. Fat Transfer: Once the fat has been prepared, your surgeon will strategically inject it into the buttocks to create the desired shape and volume. The surgeon may use several small injections at different depths and locations to achieve a natural-looking result. How Much Does a BBL Cost? One of the most frequently asked questions when considering a Brazilian Butt Lift is, “How much does a BBL cost?” The cost of a BBL can vary widely depending on several factors, including the surgeon’s experience, geographical location, and the complexity of the procedure. On average, the cost of a Brazilian Butt Lift ranges from $6,000 to $15,000. It’s important to keep in mind that this cost includes the surgeon’s fee, anesthesia, facility fees, and any necessary post-operative care. As with any surgery, you should prioritize finding a qualified, experienced, and board-certified plastic surgeon over shopping for the lowest price. Remember that you are investing in your body and your confidence, so it’s essential to choose a surgeon who will deliver the best possible results. Financing Your BBL Procedure While the cost of a BBL can be significant, there are several financing options available to make the procedure more accessible. Some plastic surgery practices offer in-house financing or partner with third-party lenders to provide patients with affordable monthly payment plans. These plans often come with a range of interest rates and repayment terms, so it’s crucial to review your options carefully and choose a plan that works best for your financial situation. Another popular method of financing a BBL is through credit cards. Many patients choose to use a low-interest or rewards-based credit card to cover the cost of their procedure. This can be a viable option, provided you have a plan in place to pay off the balance responsibly and avoid accruing excessive interest charges. Alternatively, some patients opt to save up for their BBL procedure by setting aside a specific amount of money each month. This can be an effective way to cover the cost of the surgery without incurring any additional debt. Plus, it allows you to fully appreciate the investment you’re making in yourself and your appearance. It’s important to remember that financing a cosmetic procedure is a personal decision and should be carefully considered based on your unique financial circumstances. Before making a decision, it’s a good idea to consult with a financial advisor or explore all available options to determine the best course of action. Is BBL Covered by Insurance? A common question many patients have is whether their insurance will cover the cost of a Brazilian Butt Lift. Unfortunately, because BBL is considered an elective cosmetic procedure, it is not typically covered by health insurance. Insurance companies generally only cover procedures deemed medically necessary, and a BBL is primarily performed for aesthetic enhancement rather than addressing a medical issue. That being said, there may be some exceptions. In rare cases, if a patient is undergoing a BBL to correct a congenital deformity or as part of a reconstructive surgery following trauma or cancer treatment, insurance may provide partial or full coverage. However, this is highly dependent on the specific insurance policy and the circumstances surrounding the surgery. If you believe your BBL might be eligible for insurance coverage, it’s important to discuss your situation with your insurance provider and surgeon. Conclusion The Brazilian Butt Lift is a popular cosmetic procedure that can provide patients with a more curvaceous and aesthetically pleasing silhouette. While the cost of a BBL can be a significant investment, there are various financing options available to make it more accessible. As you contemplate the question of “how much does a BBL cost?” remember to prioritize finding a qualified, experienced, and board-certified plastic surgeon to ensure the best possible outcome. Additionally, carefully consider the financing options and weigh the pros and cons based on your unique financial situation. Although a BBL is generally not covered by insurance, there may be some exceptions in rare cases involving medical necessity. It’s essential to discuss your specific circumstances with your insurance provider and surgeon to determine whether coverage might be available. In

How much do Lip Injections Cost? Costs & Financing Explained

Curious about what lip injections cost? Lip injections have become increasingly popular over the years, and it’s not hard to see why. They can enhance your natural beauty, boost your self-confidence, and may help you achieve the perfect pout. If you’re considering getting lip injections, here’s everything you need to know about the procedure, the costs, and the financing options. What are Lip Injections? Lip injections are a cosmetic procedure that involves injecting fillers into the lips to enhance their shape, size, and volume. The most common fillers used are hyaluronic acid (HA) fillers, made from a substance naturally found in the body and responsible for keeping the skin hydrated and plump. The filler is injected into the lips using a small needle during the procedure. The process is relatively quick and usually takes between 15 and 30 minutes, depending on the amount of filler being injected and the desired results. How Long Do Lip Fillers Last? One of the most common questions people ask about lip injections is how long the results last. Typically, the results of lip fillers can last anywhere from six months to a year, depending on the type of filler used and the individual’s metabolism. How Much are Lip Fillers for the First Time? The cost of lip injections can vary depending on the location, the experience of the injector, and the amount of filler needed to achieve the desired results. On average, the cost of lip injections ranges from $500 to $2,000 per session. For first-time lip filler patients, it’s recommended to start with a smaller amount of filler and gradually build up to the desired volume over time. This can help you achieve a more natural look and avoid overfilling, which can result in an unnatural appearance. How Many Sessions of Lip Filler Do I Need? The number of sessions required for lip injections varies from person to person, depending on the individual’s goals and the amount of filler needed to achieve them. Some people may only need one session to achieve the desired results, while others may require two or more sessions spaced several weeks apart. It’s important to note that lip fillers are not permanent, and the results will eventually fade over time. To maintain your desired lip volume, you may need to schedule follow-up appointments every six to twelve months. Can I Finance Lip Injections? If you’re concerned about the cost of lip injections, there are several financing options available to help you manage the expense. Some clinics offer payment plans that allow you to pay for the procedure over several months, while others may accept financing through third-party providers. Before committing to a financing option, be sure to carefully review the terms and conditions to ensure you understand the interest rates, payment schedules, and any potential fees. Lip injections can be a great way to enhance your natural beauty and boost your self-confidence. If you’re considering lip fillers, be sure to do your research, find an experienced injector, and discuss your goals and expectations beforehand. Remember, the cost of lip injections can vary depending on several factors, so it’s essential to budget accordingly and explore financing options if necessary. With the right preparation and guidance, you can achieve the perfect pout and feel more confident in your own skin. To explore your consumer loan options with our lending partner network, you can start an application here. United Credit strives to keep the content shared on this blog accurate and up to date. You are urged to consult with business, financial, legal, tax and/or other advisors and/or medical providers with respect to any information presented. Opinions expressed here are the author’s alone and have not been approved or otherwise endorsed by any financial or medical institution. This content is intended for informational purposes only. Follow us on social: Linkedin-in Facebook-f Instagram Twitter

The Ultimate Guide to a Mommy Makeover: Transforming Your Body After Pregnancy

Motherhood is a beautiful journey but can also take a toll on the body. Pregnancy and childbirth can lead to significant changes, such as sagging breasts, loose skin, and stubborn fat deposits. To restore their pre-baby body, many women choose to undergo a “mommy makeover” – a comprehensive cosmetic procedure that addresses multiple concerns at once. This blog post will guide you through what a mommy makeover is, how it works, the costs involved, recovery time, and financing options to help you decide whether this transformative procedure is right for you. What is a Mommy Makeover? A mommy makeover is a customized combination of surgical procedures designed to help women regain their pre-pregnancy body contours. Each makeover is tailored to the individual’s needs and may include one or more of the following procedures: Breast augmentation: To restore volume and shape to breasts that have become deflated or saggy after pregnancy and breastfeeding. Breast lift: To raise and reshape sagging breasts by removing excess skin and tightening the surrounding tissue. Tummy tuck (abdominoplasty): To remove excess skin and fat from the abdominal area, and repair weakened or separated muscles for a flatter, smoother appearance. Liposuction: To eliminate stubborn fat deposits in various areas, such as the hips, thighs, and abdomen, that are resistant to diet and exercise. Labiaplasty: To address aesthetic or functional concerns with the labia that may arise after childbirth. How Does a Mommy Makeover Work? A mommy makeover typically begins with an initial consultation with a board-certified plastic surgeon. During this meeting, you will discuss your concerns, goals, and expectations. The surgeon will evaluate your health, medical history, and body type to determine which procedures best address your needs. Mommy makeovers are typically performed under general anesthesia and may require one or multiple surgical sessions, depending on the procedures involved. In some cases, certain procedures can be combined into a single surgery, reducing overall recovery time and costs. Cost of a Mommy Makeover The cost of a mommy makeover varies significantly depending on the specific procedures, the surgeon’s fees, geographic location, and other factors. On average, the total cost can range from $10,000 to $30,000 or more. It’s important to note that this is a comprehensive procedure, and the cost will include surgeon’s fees, anesthesia fees, facility fees, and post-surgery care. Keep in mind that most health insurance plans do not cover cosmetic procedures, so it’s essential to discuss costs and payment options with your surgeon beforehand. Recovery from Surgery Recovery from a mommy makeover depends on the specific procedures performed and the individual’s healing capabilities. Generally, patients can expect to take about two to four weeks off from work and daily activities. Swelling, bruising, and discomfort are common during the first few weeks, and your surgeon may recommend pain medication and compression garments to manage these symptoms. It’s crucial to follow your surgeon’s post-operative instructions, including activity restrictions, wound care, and follow-up appointments. By adhering to these guidelines, you can minimize the risk of complications and ensure optimal results. Financing Your Procedure Since insurance typically does not cover the cost of a mommy makeover, many patients turn to financing options to help manage the expense. Here are some popular financing methods: Medical financing companies: These companies offer loans specifically for medical procedures, often with competitive interest rates and flexible repayment terms. Personal loans: You can apply for a personal loan through your bank or credit union, which can be used to cover the cost of your mommy makeover. Interest rates and terms will vary depending on your credit score and financial situation. Credit cards: Some patients choose to pay for their mommy makeover using a credit card, particularly if they can take advantage of a low-interest or zero-interest promotional period. However, be cautious of high-interest rates and fees, which can make this option less cost-effective in the long run. Payment plans: Some plastic surgeons offer in-house financing or payment plans that allow you to spread the cost of your mommy makeover over several months or years. Ask your surgeon if they offer such options during your consultation. Health savings accounts (HSAs) and flexible spending accounts (FSAs): If your employer offers an HSA or FSA, you can use these tax-advantaged accounts to pay for eligible medical expenses, including certain cosmetic procedures. Be sure to check the specific rules of your plan to determine if your mommy makeover qualifies. A mommy makeover can be a life-changing procedure for women looking to regain their pre-pregnancy body and boost their self-confidence. By understanding the process, costs, recovery time, and financing options, you can make an informed decision about whether this transformative procedure is right for you. Always consult with a board-certified plastic surgeon to discuss your goals and ensure you receive the best possible care and results. With proper planning and a supportive team, a mommy makeover can be a rewarding investment in your well-being and self-esteem. Ready to explore your options for financing a mommy makeover? You can start an application here. United Credit strives to keep the content shared on this blog accurate and up to date. You are urged to consult with business, financial, legal, tax and/or other advisors and/or medical providers with respect to any information presented. Opinions expressed here are the author’s alone and have not been approved or otherwise endorsed by any financial or medical institution. This content is intended for informational purposes only. Follow us on social: Linkedin-in Facebook-f Instagram Twitter

A History of Plastic Surgery by United Credit

What is plastic surgery? The truth is that cosmetic and plastic surgery and purely aesthetic surgery are far older than most people realize. Cosmetic surgery includes procedures like tummy tuck, mommy makeover, and breast augmentation, but it also encompasses treatments like skin graft procedures for burn patients and reconstruction after trauma. Patients with congenital cleft lip and palate disorders, who have undergone mastopexy because of breast cancer and need breast reconstruction with breast implants, or who have undergone facial reconstructions including facial implants after traumatic facial injury all benefit from cosmetic surgery procedures to improve their quality of life or, in some cases, even save them. At United Credit, we believe patients who are well-informed about the cosmetic procedures and other healthcare options they may seek out are more likely to make good choices in their own care and be better advocates for themselves. That’s why we’re pleased to offer you some deeper historical perspectives on this fascinating topic with this brief history of plastic surgery. Where did plastic surgery originate? The historical record shows the first documented plastic surgeries date back at least to Ancient Egypt. We know this because of the so-called “Edwin Smith Papyrus,” which has been dated to somewhere in Egypt’s Early Period or Old Kingdom between 3000-2500 BCE and was named for the American collector who “acquired” it in the 19th century. According to this document, ancient plastic surgeons conducted craniofacial surgery procedures such as primitive forms of breast surgery, nose reconstruction and rhinoplasty, how to set broken noses, and more. As far as we know, procedures performed during this time were done without anesthesia as we understand it today! However, Egypt wasn’t the only place where plastic surgery was being taken seriously. In ancient India, a text known as the Sushruta Samhita provides a glimpse into plastic surgery’s history as early as the sixth century BC, although this estimate of the document’s age is heavily disputed. Regardless of its age, the Sushruta Samhita is considered a seminal medical text covering a wide range of ailments, maladies, treatments, and surgical procedures, including the fitting of prosthetics for people who had undergone amputations. This reputation cements its place in the history of medicine. Roughly 600 years later and across the known world in Rome, an encyclopedist named Aulus Cornelius Celsus sought to gather up the collected knowledge of the Empire’s finest medical minds into a single reference, along with other references on the arts of agriculture, warfare, and law, among other things. One example is the Celsus tetrad of inflammation, which is still used as a primary diagnostic tool by many healthcare professionals, including those involved in plastic surgery, to this day. After the fall of the Roman Empire, relatively little is known about cosmetic surgery in the ancient world until the end of the Middle Ages. The next reputable reference we have is a date to the late 1500s and a man named Gaspare Tagliacozzi, an Italian physician and renowned cosmetic surgeon. His reputation was built on an innovative early iteration of the nose job, mostly to repair the damage done to the nasal area during rapier duels amongst the nobles, as well as birth defect treatment for some of the wealthiest and most powerful families in Italy. In his definitive work on the subject, De Curtorum Chirurgia per Insitionem, Taliacozzi wrote, “We restore, rebuild, and make whole those parts which nature hath given, but which fortune has taken away. Not so much that it may delight the eye, but that it might buoy up the spirit, and help the mind of the afflicted.” After Gaspare Tagliacozzi’s passing, there appear to have been relatively few significant strides in plastic surgery as we know it today until the American Civil War. Doctors on both sides dealt with men and occasionally women who had been grievously wounded on the battlefield, under horrific conditions and the ever-present threat of artillery from the other side. Despite the terrible risks and patient safety practices which could only be described as rudimentary, these physicians had access to alcohol, particularly whiskey; opium; ether; and laudanum, all of which were used to treat battlefield casualties in several ways from anesthesia to cleaning and sterilizing wounds. After the war, many physicians went back to the wider world beyond the military and began plying their trade for the health of the civilian population, pushing the bounds of cosmetic and other forms of surgical procedures as they went. Also notable on the global scale in the post-Civil War era is the world’s first successful surgery performed under general anesthesia, a mastopexy undertaken in Japan in the early 1890s. In 1895, when Vincent Czerny, a physician, and professor in Heidelberg, Germany, performed the first breast reconstruction using tissue harvested from a woman’s back as a sort of primordial breast implant, he secured his place in plastic surgery history and the era of modern cosmetic surgery truly began. Did you know breast augmentation is the most commonly performed plastic surgery procedure in America according to the American Society of Plastic Surgeons? This marked a quantum leap of innovation and advances in nearly every area of plastic surgery, but in a twist of irony, it would be WWI and WWII which drove the next immense strides. With battlefield medical technology at an all-time high, wounds that would have been disfiguring or even fatal only sixty or eighty years before were now treatable. The discoveries and advances made during this period truly heralded the beginning of modern plastic surgery history. After WWII, a group of American surgeons, many of whom had seen action across the face of the globe in support of the Allied war effort, formed the American Society of Plastic Surgeons. In the ensuing years, virtually every area of the human body, and our understanding of how it functions, has been touched by plastic and reconstructive surgery. Today, organizations such as the American College of Surgeons and the Royal College of Surgeons, along with ASPS and their overseas counterparts, exchange news updates, communication, conversation, information,

How to Finance Plastic Surgery [What to Know]

Approximately 1.4 million plastic surgeries are performed each year in the United States. Some of the most popular plastic surgery procedures are: Breast implants Nose jobs Facelifts Liposuction Tummy tucks Plastic surgery can come with a significant price tag, and cosmetic procedures are not typically covered by health insurance plans. But if you’re unhappy with an aspect of your appearance, plastic surgery may be well worth the cost. Not only can cosmetic surgery potentially improve your appearance, but it may also boost your self-esteem and bolster your self-confidence. Considering the high cost of most cosmetic surgeries, it’s normal to wonder how to finance plastic surgery. Can you get financing for plastic surgery? And what about plastic surgery financing with bad credit? Fortunately, there are plenty of medical financing solutions available. If you can‘t afford plastic surgery, consider getting a loan through United Credit’s lending partners. Thanks to our vast lending partner network, United Credit can help you finance plastic surgery. Read on to learn how The Benefits of Financing for Plastic Surgery At United Credit, we believe everyone should have access to plastic surgery procedures without the stress of dipping into savings or racking up credit card debt. Financing for plastic surgery provides patients with many benefits. Flexible Repayment Terms United Credit provides an extensive list of trusted lenders, giving you various loan options. This lets you choose the repayment and loan terms that best suit your budget, needs, and preferences. Fast Financing United Credit works alongside a vast network of lending partners, so you can get financing for plastic surgery when you need it. If you qualify for pre-approval, you’ll receive financing options within minutes of completing your application. Otherwise, you’ll receive more information once we match you with our lending partners. Ability to Secure Plastic Surgery Financing with Bad Credit Not every patient has stellar credit, and that’s understandable. Unfortunately, poor credit scores can often deter patients from seeking the procedures that would help improve their lives. With help from United Credit, you can access options for plastic surgery financing with bad credit, excellent credit, or anything in between. Ability to Choose How Money Is Spent Financing for plastic surgery shouldn’t be limited to the cost of the surgery itself. Surgery often requires recovery periods, so you may miss out on wages or face other expenses during this time. Fortunately, our financing solutions provide you with the flexibility to choose how to spend your loan. Ability to Get Plastic Surgery Sooner Plastic surgery can be expensive, and it can be difficult for patients to pay the entire cost of a procedure upfront. Many medical facilities don’t provide repayment plans, so patients may feel they need to put off having surgery. With financing options through United Credit’s lending partners, you can get the surgery you need right away without draining your bank account or waiting to save up for the procedure. Easy Application Process We provide a simple online application and a streamlined application process. Applications can be completed in a few minutes and only require basic information about you, your income, and your contact information. After you complete an online application, we will submit it to our lender network. If you pre-qualify, you will receive a financing option within minutes (or up to one business day) after the application is submitted. If one of our lending partners approves your loan request, we may contact you to review the terms and conditions. Once the terms are accepted and any stipulations are provided, the lender will disburse the funds you have requested. How to Finance Plastic Surgery: Average Costs The cost of cosmetic procedures varies from state to state, but here are some average prices of eyelid surgery, breast augmentation, and other popular aesthetic surgical procedures: Botox: $385 Eyelid surgery (blepharoplasty): $3,022 Cheek implants: $2,823 Facelift (rhytidectomy): $7,048 Forehead/brow lift: $3,403 Chin augmentation: $2,225 Lip augmentation: (other than injectable materials) $1,727 Nose surgery: (rhinoplasty) $5,046 Breast augmentation: $3,824 Abdominoplasty (tummy tucks): $3,000 to $8,500 Can You Make Payments on Breast Implants or Other Cosmetic Surgical Procedures? Yes. You can get a loan for plastic surgery and then make payments on that loan. However, it is worth first checking with your health insurance provider to see if they will cover part of the procedure. Conditions that cause discomfort or pain may qualify for coverage. Procedures like breast reconstruction and skin grafts are often covered. Insurance plans will not pay for plastic surgery if the reason is purely aesthetic unless the issue results from a congenital disability, disease, or trauma. For example, an insurance company may cover the costs of surgery to correct a cleft palate, but it’s unlikely they’ll cover a rhinoplasty if the only reason for the nose job is to improve appearances. Each cosmetic surgery procedure has its own set of considerations, and The American Society for Aesthetic Plastic Surgery provides detailed information on how to prepare for them. Do Plastic Surgeons Offer Payment Plans? Yes. Some surgery centers offer installment loans based on the specifics of your financial situation. However, even if you have an excellent credit score, you will be limited in your choice of lenders. United Credit works with an extensive network of lenders, which means you may get a lower interest rate. Plan for Your Plastic Surgery Loan Before you schedule cosmetic surgery, you should make a list of all costs. Some common costs that patients consider when deciding between various loans and monthly payment plans include: Cost of the surgery itself Number of nights in the hospital Recovery costs like medical supplies and medications Downtime from work Knowing your total expected costs helps when choosing monthly payments that fit your budget. What Does United Credit Offer? United Credit can help you get financing for plastic surgery. We help consumers with a wide range of credit scores apply for financing through our lending partner network. In other words, we connect people like you with the loan you need. We are not a credit card company. Instead, we are a gateway to installment

Do Cosmetic Surgery Results Last?

How Long Will the Results of Cosmetic Surgery Last? If you’re contemplating cosmetic surgery, you may wonder how long cosmetic surgery results last. Some cosmetic procedures last a long time, while others require maintenance or regular refreshing. Let’s look at some of the most popular procedures, how long the results typically last, and how you can help maintain your new look with some tips and tricks. 1. Body Contouring Body contouring can remove excess skin, improve the appearance of the skin’s firmness and remove excess fat. With healthy lifestyle choices, body contouring, including cosmetic procedures like liposuction, can last for years. In some cases, results last up to a decade. Tips/Tricks: Eat a healthy diet. Exercise regularly. Drink lots of water. Get plenty of sleep. 2. Nose Job Does plastic surgery, like nose jobs, last forever? A nose job, or rhinoplasty, is a long-lasting surgery. However, the nose does change and grow as you age. Gravity and natural aging cause the cartilage to break down. This process causes facial areas like the ears and nose to sag more. Some people undergo a later-in-life nose job to return their nose to its former look. Tips/Tricks: Allow yourself to rest for a full recovery after surgery. Sleep on your back rather than in a fetal position. However, it’s important to remember that aging is natural; you can’t avoid it with surgery. 3. Breast Lifts Results vary for breast lifts depending on many patient factors, including the following: Age Genes Habits Diet Exercise Some patients enjoy long-term results, while others choose a refresher surgery after a few years. Like many cosmetic surgery outcomes, you can do a lot to help your new look last longer. Tips/Tricks: Wear a supportive bra. Maintain a steady weight. Avoid the sun. Eat a healthy diet. 4. Breast Implants Breast implants last forever, but you’ll need to replace the filler inside every 10-15 years. The breast tissue around the implant shifts over time, so many women undergo a second surgery after about a decade. If this happens, a breast lift can help correct the placement. So-called “Gummy bear implants” also need replacement after the first decade or two. Tips/Tricks: Follow your physician’s advice during recovery. Get regular, yearly checkups. Perform regular self-checks. Get an MRI 5-6 years after surgery and every 2-3 years after that. 5. Tummy Tucks The results of a tummy tuck surgical procedure depend on the patient. Many patients enjoy lasting, lifelong benefits from their tummy tuck. However, gaining more than 20% of your total body weight may be detrimental. Pregnancy can also reverse the effects of a tummy tuck unless you return to your pre-pregnancy weight and shape. Genetics may affect the lasting results, but lifestyle choices that put health first do help. Tips/Tricks: Rest for a full recovery after surgery. Maintain a steady weight through exercise and diet. Stop smoking. Consider liposuction to help maintain the results. 6. Chin Implants A chin augmentation involving an implant is a permanent procedure and should last a lifetime. Many patients pair other cosmetic procedures, like a neck lift, to achieve a more defined jawline. Body contouring, like liposuction, may also be a part of the plan for a patient’s ideal chin profile and appearance. Depending on how a person ages, there may be a need for a refresher procedure after a few decades. Tips/Tricks: Follow your surgeon’s advice for a full recovery. Avoid weight gain. Stop smoking. Sleep on your back rather than in a fetal position. Get Financing Today How long does plastic surgery last? You can do a lot to ensure the longevity of your cosmetic surgery results. Taking time for a full recovery, maintaining a healthy lifestyle, and staying hydrated helps you get the best results. United Credit offers some of the best plastic surgery financing available. Please click here to learn more about our cosmetic surgery financing programs. United Credit strives to keep the content shared on this blog accurate and up to date. You are urged to consult with business, financial, legal, tax and/or other advisors and/or medical providers with respect to any information presented. Opinions expressed here are the author’s alone and have not been approved or otherwise endorsed by any financial or medical institution. This content is intended for informational purposes only. Follow us on social: Linkedin-in Facebook-f Instagram Twitter

How to Finance Plastic Surgery with Less-than-Perfect Credit [12 Options]

Medical practitioners performed over 15.6 million cosmetic procedures in the United States in 2020, even with the pandemic slump. Plastic surgery financing continues to be a trending topic. People want to look good and be proud of their bodies. They want to cover up scars from accidents, operations, and cancer treatments, and are willing to pay a premium for it. Americans spent more than $14.6 billion on cosmetic and plastic surgery procedures in 2021. The story is different for credit-challenged people, i.e., those with FICO scores below 550. Cosmetic and plastic surgeries are expensive, and people with less-than-perfect credit struggle to get financing to undergo the procedures they want or need. However, there is hope. When seeking how to get plastic surgery financing with bad credit, consider these 12 brilliant options. 1. Health Insurance If you have health insurance, you may not need to pay the total cost of the surgery from your pocket. As long as the procedure you seek is medically justifiable, insurance may cover most, if not all, of it. Insurance may cover a nose job to correct breathing difficulty, eyelid surgery for victims of fires or accidents, breast reduction surgery to ease severe back pain, for example. However, insurance doesn’t typically cover cosmetic procedures performed primarily to improve one’s appearance or boost self-confidence. 2. A 401(k) Loan For those contributing to an employer-sponsored retirement account, a 401(k) loan is one way to finance plastic surgery. This loan is one of the few options with manageable interest rates for credit-challenged individuals. Similar to using health insurance to cover the cost of a procedure, you may not be able to get a 401(k) loan for purely elective cosmetic procedures. If you require surgery to correct a congenital disability, a genetic anomaly, or a disfigurement caused by a disease or an accident, check your plan documents or reach out to your retirement account administrator to get details about your account’s available loans. 3. Home Equity Loan Homeowners with accumulated equity may be able to take out a second mortgage on their property. The most significant consideration for creditors is collateral rather than the applicant’s credit. If you can leverage your home as collateral, your credit may not be much of a hindrance. Home equity loans generally have fair interest rates, and you can use the loan for either medically necessary or elective plastic and cosmetic surgeries. Please note that if you default on loan payments, you risk losing your home. 4. Personal Loans Some local banks and credit unions offer loans to borrowers with less-than-perfect credit, and you can use the loan for any purpose. The creditors cover their risk by charging fixed interest rates as high as 36%, depending on the applicant’s credit. Credit unions only give out personal loans to members. Personal loans often have long repayment schedules. While this reduces your monthly payments, it may take over five years to repay the loan. In the end, you’ll pay over double the original loan amount. 5. Hospital Payment Plans When searching for how to get plastic surgery financing with bad credit, consider inquiring with your medical provider. Some hospitals and outpatient surgery facilities offer patient payment plans, allowing you to put down an initial lump sum, then pay off the rest of your bill over time. However, facilities offering this option are limited, and most require a good credit score. Applicants with less-than-perfect credit often need to put down additional collateral and agree to higher interest rates on the loans. 6. Online Lenders Hundreds of online lenders offer loans to applicants with less-than-perfect credit. However, loan amounts tend to be smaller, and the loan terms are often unfair, if not exploitative, to the borrower. Payday loans are the most common, but these have astronomical fees and interest rates, on average, between 100 – 350%. You can use these general-purpose loans for either medically necessary or elective plastic and cosmetic surgeries. However, making payments on time and paying off the balance as agreed is imperative. Failure to do so comes with steep penalties and more damage to your credit. 7. United Credit United Credit provides a breath of fresh air to people with less-than-perfect credit seeking financing for virtually all cosmetic and plastic surgery procedures. These include facelifts, facial reconstructive surgery, liposuction, nose surgeries, breast augmentation or reductions, hair restoration, and many more. Because United Credit works with multiple lenders, applicants have many loan terms from which to choose. United Credit financial partners offer loans up to $25,000* with competitive interest rates and affordable monthly payments**. 8. Medical Credit Card One of the ways to finance plastic surgery is with a medical credit card. These cards are created to help pay for medical bills and usually come with special financing offers during a certain introductory period. For example, some medical credit card providers offer a 0% annual percentage rate (APR) if you pay off your balance within 6 to 24 months. Most medical providers, including cosmetic surgeons, accept these cards. However, take caution when using them, as they can come with high APRs if you fail to adhere to the specified payment plan. If you still have a balance after the 0% APR period, interest can be high, and you can be charged deferred interest from the original purchase date. 9. Installment Loans Consider an installment loan if you’re wondering how to get plastic surgery financing with bad credit. These loans are similar to personal loans, except they come with specific repayment terms. Payments are typically the same throughout the loan, occurring weekly, bi-weekly, or monthly. These loans can have fixed or adjustable interest rates and may be collateralized or non-collateralized. It’s important to note that most lenders consider your credit score, income, debt, and bank account transactions before approving an installment loan. If you don’t make a payment on time, it can hurt your credit score, and you could lose the collateral you put up to get the loan. 10. Personal Credit Card Medical providers typically accept personal credit cards for elective procedures. You can use a low-interest credit card or apply for a new one. However, credit cards can come with high-interest rates, so select an option with a reasonable rate. Consider applying for a credit card with a 0% APR offer. These cards allow you to split the cost of the procedure into monthly payments without interest as long

Finance Your Liposuction With An Affordable Loan Solution

Most people want to look their best but may need a little help with issues like belly fat and other problem areas of the body. Through the miracle of modern medicine, a lot of these complaints can be addressed and resolved. But one question often comes up: How can I pay for them? This guide outlines liposuction and other weight loss procedures, and how to finance the treatment you want or need to achieve your health goals through a loan for liposuction. Financing Cosmetic Surgery Your skin can’t always bounce back after weight gain or weight loss. Weather conditions can also cause your skin to become dry, resulting in a loss of suppleness and firmness. In these situations, cosmetic surgery may be the answer. Most health insurance plans don’t cover cosmetic surgery, which can get expensive. Thankfully, financing options exist for those who can’t afford to pay for the surgery out of pocket. Here’s more information on how to find a loan for liposuction. Why Cosmetic Surgery? In some cases, weight loss through natural methods does not always happen quickly enough for some people. Others may need help when diet and exercise fail to accelerate their attempts to shed extra pounds. Some people opt to seek their desired results through cosmetic surgery. Whether for weight loss or other situations, cosmetic surgery can help those who want to look better and feel better about how they look. Choosing Liposuction During liposuction surgery, the physician inserts a thin cannula beneath the skin’s surface, suctioning out the fat tissues. This procedure firms and tones the skin, producing a smooth and slimmed-out appearance. Although liposuction removes fat tissues from the body, it is typically not recommended for obese individuals or persons with health issues. When seeking liposuction, patients should be within 30% of their ideal body weight and have good muscle tone. You should consult a medical professional or doctor for more information on your unique situation. What to Know About Financing Your Weight Loss Procedure We’ve compiled answers to commonly asked questions about financing liposuction. 1. How Much Does Stomach Liposuction Cost, on Average? According to the American Society of Plastic Surgeons, the average surgeon’s fee for one area of liposuction is $3,518. The average tummy tuck cost is $6,154. Additional fees may apply, including those associated with the anesthesia provided during the procedure and the surgical center. 2. What Factors Affect the Cost of Liposuction? Some of the factors that can impact the cost of liposuction include the following: Location Pre- and post-operative fees Treatment area(s): Larger areas, such as the abdomen, are typically more expensive The technology used to perform the procedure Facility costs 3. What Is Included in the Cost of Liposuction? The cost of liposuction usually includes: Medical tests Operating room fees Anesthesia Hospital room costs Post-surgery garments Surgeon’s fees Any medication you may need while undergoing the procedure 4. Is Medication Included in the Cost of Liposuction? Although medications given during the procedure and recovery period may be included in the cost of liposuction, typically any prescriptions provided would likely come at an additional cost. 5. How Can I Finance My Liposuction Treatment? If you’re wondering how to afford liposuction and other weight loss surgery, consider these financing options if you’re interested in a loan for liposuction. Obtain a High-Limit Credit Card Medical credit cards offer options for those seeking cosmetic surgeries and liposuction procedures. For any medical credit card, you’ll provide the reason for opening an account, doctor or physician information, and personal and financial details. The financing rates are a little high, making it a relatively expensive option. Borrow from Your Retirement Plan You may be able to borrow up to 50% of the balance you have vested in your 401(k) plan. The repayment process typically involves automatic paycheck withdrawals and can take years. Weigh the penalty and tax ramifications of this option. If you cannot repay the money, for whatever reason, you will pay taxes on the amount borrowed, plus any penalty fees. If you quit or lose your job, you typically have two months to pay off the loan; otherwise, you must claim it as a distribution and settle any taxes and penalties. Take Out a Loan When considering a loan for liposuction and other surgical procedures, it’s wise to utilize lending partners who focus on healthcare. These institutions specifically support patients who need medical procedures and cosmetic surgery. They may also offer competitive financing options, such as interest-free payments and flexible payment schedules. Many businesses offer personal or medical loans for cosmetic procedures like liposuction. A loan for liposuction is an increasingly popular option for those who want the cosmetic procedure but cannot afford to pay out of pocket. These types of loans generally have a simple application process. A person usually needs an average credit rating, good financial standing, and the ability to make monthly payments. Financing Liposuction United Credit offers many competitive financing options for your healthcare needs. The payments vary depending on your credit rating, the amount of the loan, and the financing percentage rate, or APR. Take the next step toward meeting your goals by applying for financing through United Credit. Follow us on social: Linkedin-in Facebook-f Instagram Twitter