- (855) 503-1800

- 1 Park Plaza, Ste 600 Irvine, CA 92614

More results...

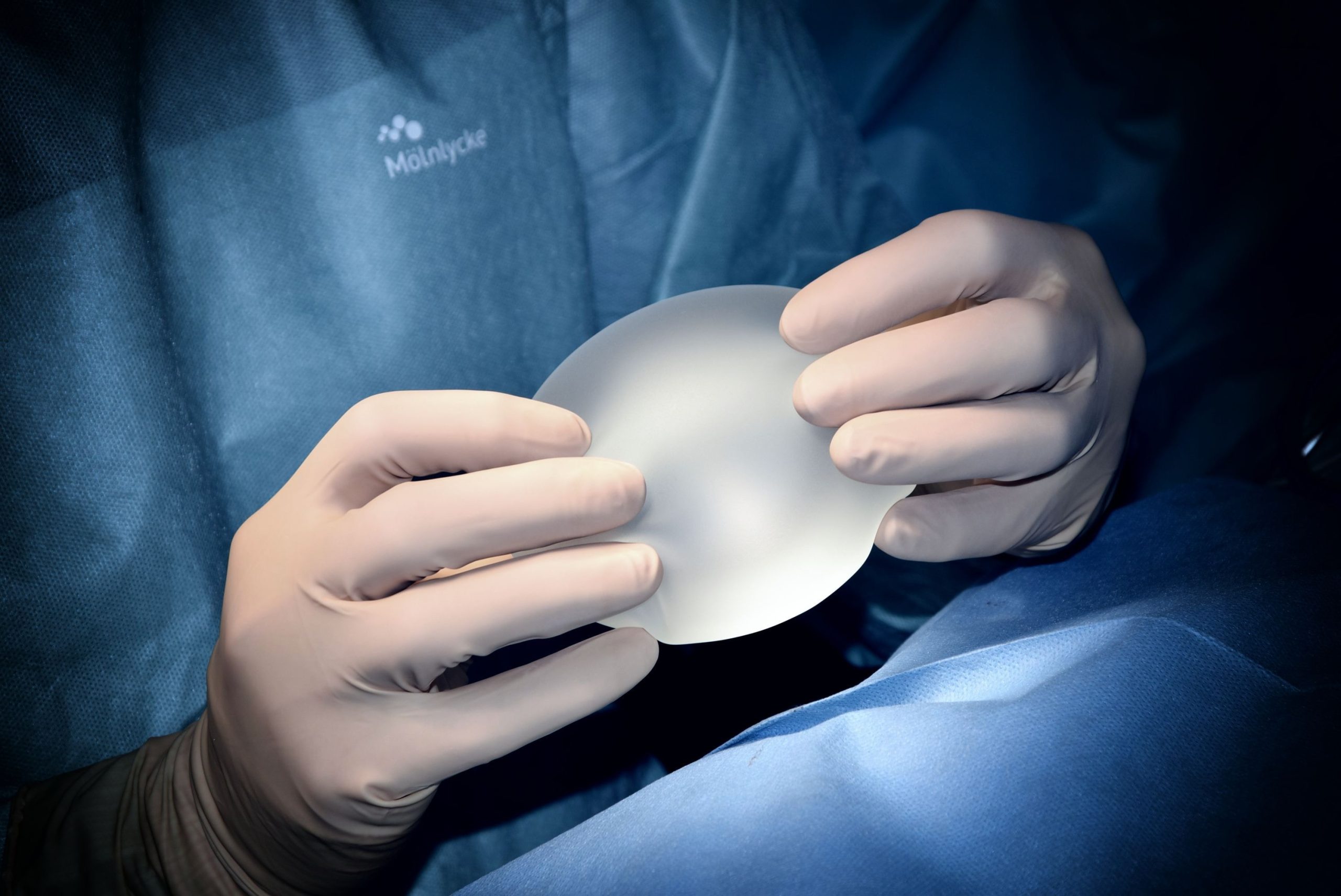

Breast augmentation is a popular cosmetic procedure that can enhance your confidence and self-image. However, the cost of breast augmentation can be a significant factor that may deter some individuals from pursuing their desired aesthetic goals. Fortunately, there are financing options available that can make breast augmentation more accessible. In this comprehensive guide, we will explore how to finance breast augmentation with confidence, empowering you to make informed decisions about your financing options and embark on your transformational journey.

Breast augmentation financing refers to the financial assistance provided by reputable lenders or specialized medical financing companies to cover the cost of the procedure. By spreading the cost over a set repayment period, financing options enable individuals to undergo breast augmentation without having to pay the entire amount upfront.

Achieve your desired results sooner: Financing breast augmentation allows you to proceed with the procedure when you’re ready, rather than waiting until you have saved enough money. This way, you can attain your desired results and enjoy the benefits of an enhanced silhouette sooner.

Customized repayment plans: Financing options offer flexible repayment plans tailored to your financial situation. You can choose a repayment period that aligns with your budget and comfortably manage your monthly payments.

Maintain financial stability: Financing allows you to preserve your financial stability rather than depleting your savings or disrupting your regular budget. You can retain your savings for unexpected expenses or future investments while pursuing your desired breast augmentation procedure.

Access to reputable providers: Financing options often work in collaboration with reputable cosmetic surgeons and clinics, ensuring that you have access to experienced professionals who prioritize your safety and satisfaction.

Research reputable lenders: Start by researching and identifying reputable lenders or medical financing companies that specialize in cosmetic surgery procedures. Look for companies with a track record of providing transparent terms, competitive interest rates, and excellent customer service.

Evaluate your financial situation: Assess your financial circumstances, including your income, expenses, and credit score. Understanding your financial position will help you determine the loan amount you can comfortably manage and qualify for.

Consult with a board-certified plastic surgeon: Schedule consultations with board-certified plastic surgeons experienced in breast augmentation. Discuss your goals, expectations, and any concerns you may have. They can provide you with a detailed treatment plan and cost estimate, which will guide your financing decisions.

Compare financing options: Obtain quotes from different lenders or financing companies and compare their interest rates, repayment terms, and fees. Look for options that align with your budget and offer the most favorable terms.

Understand the terms and conditions: Before finalizing any financing agreement, carefully review the terms and conditions provided by the lender. Pay attention to the interest rate, repayment schedule, any associated fees, and penalties for late payments or early repayment.

Apply for financing: Once you have selected a financing option, complete the application process. Be prepared to provide the necessary documentation, which may include proof of income, identification, and details about the planned breast augmentation procedure.

Plan your budget: Once you receive approval for financing, develop a comprehensive budget that includes the loan payments along with other associated costs, such as pre-operative tests, surgical fees, post-operative care, and potential follow-up visits.

Maintain a realistic outlook: While financing allows you to achieve your desired breast augmentation, it’s important to maintain realistic expectations. Communicate openly with your plastic surgeon about the outcomes you desire, ensuring that you have a clear understanding of what can be achieved through the procedure.

Schedule your procedure: With the financing in place and a well-planned budget, schedule your breast augmentation procedure with your chosen plastic surgeon. Follow all pre operative instructions provided by your surgeon to ensure a smooth and successful procedure.

Manage your loan payments responsibly: Once your breast augmentation is complete, it’s crucial to manage your loan payments responsibly. Make timely monthly payments to the lender, prioritizing your financial obligations to maintain a positive credit history. This will help build your creditworthiness and potentially open doors to future financing opportunities.

Financing breast augmentation can provide a practical solution for individuals seeking to enhance their self-confidence and achieve their aesthetic goals. By understanding the available financing options, evaluating your financial situation, and working with reputable lenders and experienced plastic surgeons, you can embark on your breast augmentation journey with confidence. Remember to research and compare financing terms, create a realistic budget, and maintain responsible financial management throughout the repayment period. With the right financing strategy, you can access the transformative benefits of breast augmentation and embark on a journey to a more confident and empowered you.

As Chief Sales and Marketing Officer, Nate expertly drives revenue growth for United Credit by leading sales and marketing strategies across all channels. With over 20 years of experience working with global brands in various industries, Nate has a proven track record of boosting sales, expanding market share, and building strong relationships. His unique ‘right-brain + left-brain’ approach combines business acumen and strategic thinking with striking creative execution, ensuring United Credit’s sales and marketing efforts consistently deliver results for continued success.

Matthew is the President and Founder of United Credit. Matt founded fintech company United Medical Credit in 2011 to connect consumers and businesses with an array of experienced, innovative financing solutions. In 2022, the company grew and became United Credit, fueling an expansion into retail markets while retaining its expertise in specialty healthcare.

Since its founding, Matt has provided leadership for all aspects of the Company, emphasizing long-term growth while ensuring United Credit delivers value to its consumers, merchants, and business partners. The Company has risen in the fintech space as a preferred consumer financing partner under his tenure.

Matt is also an active member of YPO (Young Presidents’ Organization), the world’s largest leadership community of company chief executives.