- (855) 503-1800

- 1 Park Plaza, Ste 600 Irvine, CA 92614

More results...

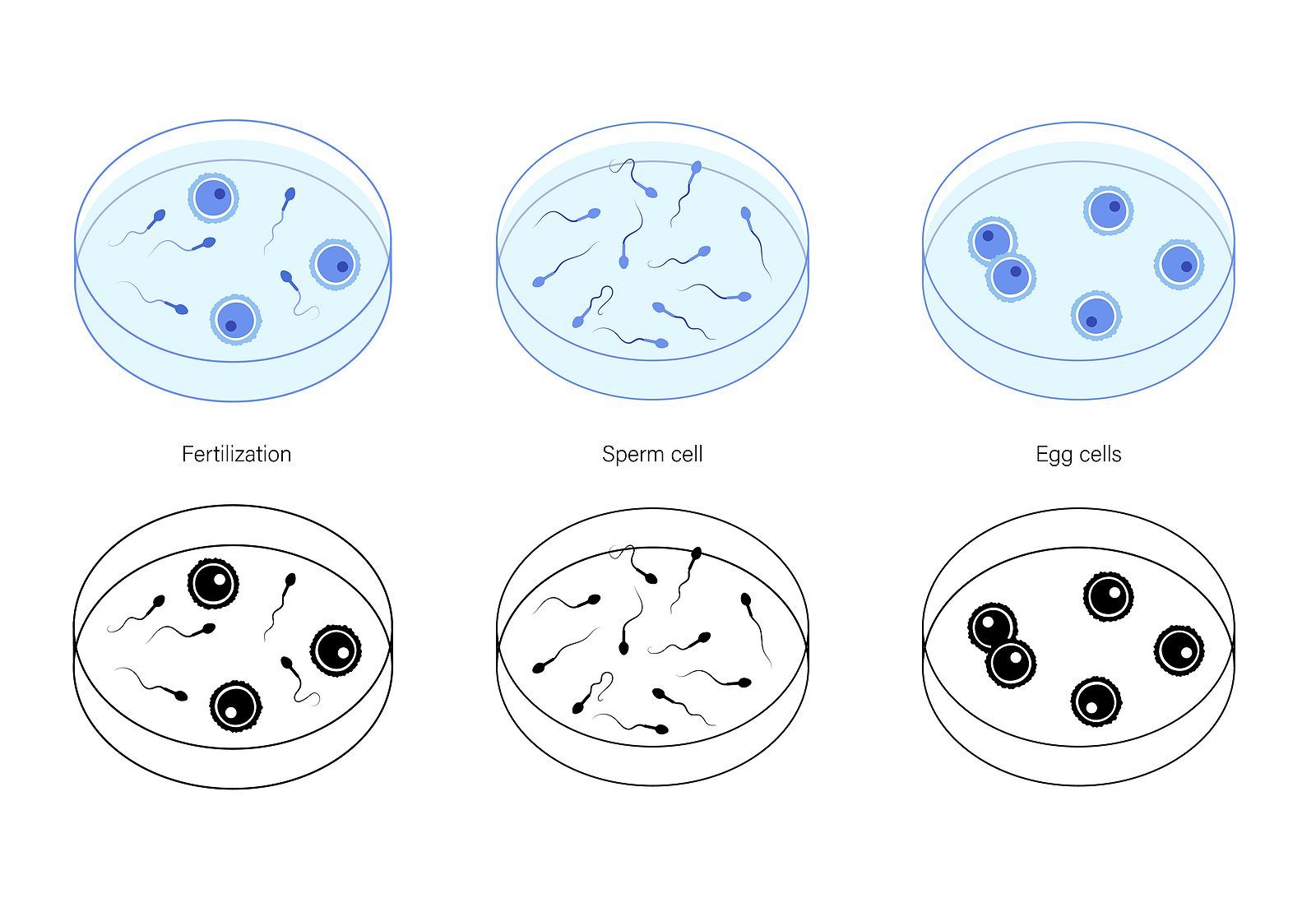

At United Credit, we believe you, the patient, deserve the best possible outcomes for your medical needs, including your family planning. But to get the best outcome, we first need to answer the question, “How much does IVF cost?” To get an idea of the costs associated with IVF and other assisted reproductive technologies, we sat down with a representative from CARE Fertility to discuss baseline costs and other considerations. Here’s what they had to say!

Please tell us a little about yourself and your experience with in vitro fertilization (IVF) treatment.

CARE Fertility has been a leading provider of Reproductive Medical Services in Southern California for over 12 years, with many thousands of miracles born with our assistance.

Treatment costs vary dramatically depending on a number of factors including individual patient needs, the state of residence, and other clinic-related considerations. In California, the average cost is around $15,000 per cycle, without the cost of medications. Here at CARE Fertility our base IVF package is $12,000 per cycle and includes all of our clinic, surgical and embryology services. Some states have mandated insurance coverage for fertility treatments and some do not. Here in California, only diagnostic testing is required to be covered. However, some insurance and benefits plans do include IVF coverage, so it’s always best for the patient to understand both their individual insurance coverage and their state-mandated coverage, so they’ll know what is covered.

The variables are twofold. One is clinical needs and the other is patient preference. The clinical considerations that could impact treatment costs usually relate to the medications required and any other clinical examinations, testing, or procedures that may be necessary prior to beginning an IVF cycle. The patient preferences relate more to options that are available to US patients due to the advanced state of the industry in this country. Such options would include pre-implantation genetic testing (PGT-A testing) of embryos, which enable parents to not only ascertain the health and viability of the embryos but also select the gender of the embryos if they so choose. Another would be patients opting for all-inclusive packages with a clinic that would include all associated medication, testing, and other optional costs.

The general consensus is that utilizing PGT does shorten the time to a successful pregnancy as it generally is more likely to lead to a positive pregnancy. However, due to the complexity and myriad factors involved in achieving a successful pregnancy, such considerations are best discussed between a patient and their physician directly.

IVF is considered the gold standard of fertility treatments when it comes to achieving a successful pregnancy. However, it is not required in all instances and many patients may be suitable candidates for IUI [intrauterine insemination] which has a significantly lower cost (~$2000). Ultimately, every patient’s needs and specific situations are different and again it is always advised to speak with a Board Certified Reproductive Endocrinologist to understand individual needs and options.

Ordinarily, clinics will quote for their services excluding medications, since those are purchased through specialty pharmacies. Some clinics will include a set amount of medications in packages they provide to patients. The other factor to bear in mind with egg freezing packages is the number of years of cryo-storage that is being provided and the ongoing annual charge for that clinic.

My earnest advice for anyone in any way concerned or has questions about their fertility is to speak with a Double Board Certified OBGYN & Reproductive Endocrinologist. CARE Fertility, as well as many other clinics, offer free initial consultations for patients with a physician so everyone can understand their individual options and situations better before making decisions on how to grow their families. I would also advise individuals to check their state-mandated and individual insurance coverage for infertility treatment and testing. Here in California, testing is nearly always covered and the best first step for anyone would be to speak to a physician and get diagnostic testing completed so as to be able to make their decisions from a truly informed place.

Ultimately, the fertility industry in the United States is the most advanced in the world and we routinely help patients in extremely difficult circumstances achieve successful pregnancies. So, my advice to anyone concerned is to simply reach out to a local clinic and let fertility experts provide much-needed guidance and understanding.

UMC can help make affording fertility treatment including IVF easier!

The national average IVF success rate for individual fertility treatments is around 25%, placing the cost of IVF out of reach of many people. However, many fertility centers offer a money-back guarantee, so it’s worthwhile to ask about your chosen provider’s policies and review their patient testimonials for more information.

Before you dip into your savings account or FSA (flexible spending account), max out your credit cards or take out a mortgage on your home, be sure to find out what your insurance covers. Then talk to United Medical Credit. We specialize in helping people connect with the perfect loan, and lender, which can help them realize their family planning dreams. Whether you want a bouncing baby boy or girl, UMC’s dedicated lender network helps take the strain out of affording treatment. Our partners’ lending options help you to start or grow your family, allowing you to focus on maintaining a healthy diet, exercise, physical fitness, and emotional well-being and getting everything you need to prepare for the live birth you’ve been dreaming of!

UMC gives you access to a range of lenders offering loans for expenses associated with affordable fertility treatments which may not be covered by insurance providers, including:

As well as the items listed above, UC’s partner lenders’ fertility financing options can help you manage certain other costs associated with but not directly part of the cost of average IVF or fertility treatment. This especially includes items like travel, food, lodging, miscellaneous fees, and so on. Because it’s your money, you can use it anywhere, at any clinic, in the ways you need to maximize your chances of a successful pregnancy. Lenders in our network can even arrange to pay your fertility centers and fertility specialists directly, taking the stress of medical bills out of the equation while you focus on creating a new member of your family!

To find out more about how UC’s robust network of dedicated medical lenders can help you with your family planning, check out our patient resources.

When you’re ready to get started with our simple, fast medical loan application, you can access our patient portal by clicking here!

As Chief Sales and Marketing Officer, Nate expertly drives revenue growth for United Credit by leading sales and marketing strategies across all channels. With over 20 years of experience working with global brands in various industries, Nate has a proven track record of boosting sales, expanding market share, and building strong relationships. His unique ‘right-brain + left-brain’ approach combines business acumen and strategic thinking with striking creative execution, ensuring United Credit’s sales and marketing efforts consistently deliver results for continued success.

Matthew is the President and Founder of United Credit. Matt founded fintech company United Medical Credit in 2011 to connect consumers and businesses with an array of experienced, innovative financing solutions. In 2022, the company grew and became United Credit, fueling an expansion into retail markets while retaining its expertise in specialty healthcare.

Since its founding, Matt has provided leadership for all aspects of the Company, emphasizing long-term growth while ensuring United Credit delivers value to its consumers, merchants, and business partners. The Company has risen in the fintech space as a preferred consumer financing partner under his tenure.

Matt is also an active member of YPO (Young Presidents’ Organization), the world’s largest leadership community of company chief executives.